About

Experience has been gained in Australia, New Zealand, Europe and North America. Sector expertise includes funding to the following industries:

- Biotech

- AgriTech

- PropTech

- Property

- Waste/Water Management

- Green Energy

- Oil and Gas (IP)

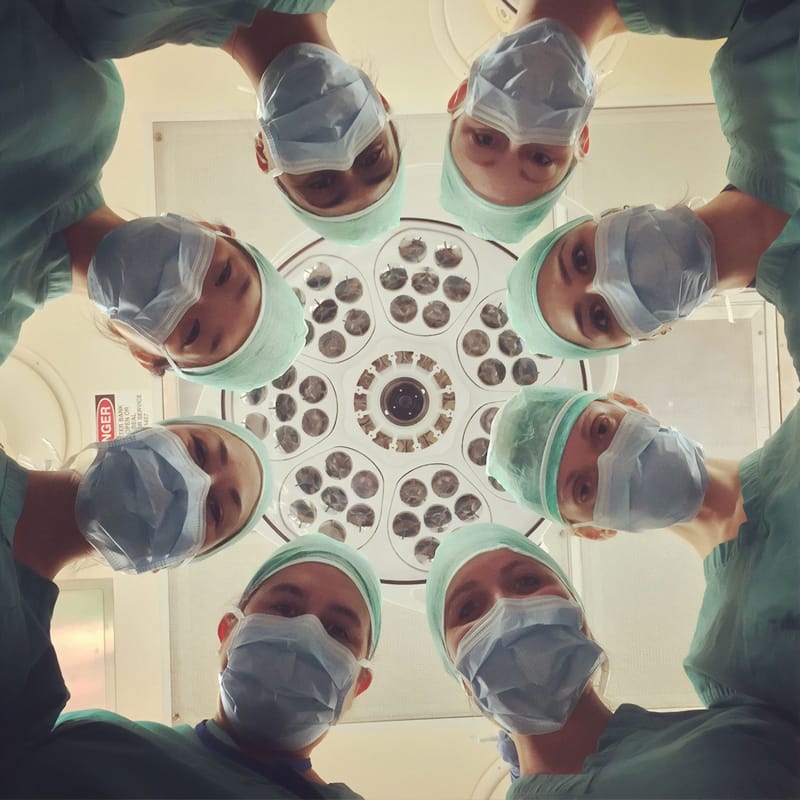

- Health

- Finance

- and others

Team

Mark Kogos

DirectorMark Kogos B. Arts (Economics)/ LLB (Auckland); M. Commerce Law (Auckland) Mark has 25 years experience in the finance and mergers and acquisitions industry, including sourcing, structuring, arranging and implementing domestic and cross border finance and M&A transactions for major Australian and international corporate groups and domestic financial institutions. Mark was Director in charge of Corporate Structured Finance at National Australia Bank, Head of the Trans-Tasman Desk at PricewaterhouseCoopers whilst starting his career as a banking lawyer with Minter Ellison in Auckland New Zealand.

Cheyne Ghoughassian

DirectorCheyne has 30+ years experience in the banking and finance industries including starting up two boutique funding firms. Cheyne's career highlights include: Owner/Founder – Carche Finance & Consulting / Head of Financial Institutions Group, Australia & New Zealand - BNP Paribas / Director Financial Institutions Group, NAB / Owner/Founder – Thyme Financial Group Ltd / Senior Manager, Financial Institutions Group, Deutsche Bank AG.

Dr Vik Kortian

ConsultantDr Kortian is the Managing Director of the Performance Improvement Institute. He has been advising and working with Australian and Multinational organisations on Business Excellence and Organisational Transformation for over 25 years. He was Director of Performance Improvement at PriceWaterhouseCoopers leading the Lean Six Sigma practice as well as the Director Lean Six Sigma Deployment / Transformation for the Asia Pacific Region for Unisys. Prior to his foray into the consulting world Dr Kortian spent 20 years working for Dow Corning holding a number of senior operational and managerial positions including a 3-year stint at the corporation’s Global headquarters in Midland Michigan where he patented and commercialised new emulsion products and processes. Dr Kortian holds an honours degree in Chemical Engineering from the University of NSW, a Master’s in Business Administration, a Master of Arts (Research), and a PhD in Business from Macquarie Graduate School of Management. Dr Kortian has been an Adjunct Lecturer at a number of Australian leading Business Schools including the Australian Graduate School of Management, Kaplan Business School, and Macquarie Business School (formerly Macquarie Graduate School of Management) teaching the Lean Six Sigma Executive Education programs, Operations Management, Statistics, Big Data Analytics, Artificial Intelligence and Machine Learning, Supply Chain, Innovation and Entrepreneurship, and Project Management. In 2020 Dr Kortian was appointed to the DeakinCo. board to oversee the development of its Executive Education. In 2019, Dr Kortian was appointed to the Faculty of Engineering at Macquarie University leading the preparation and delivery of the Masters of Engineering Management. His research interests are Big Data Analytics, Business Excellence Models, and Organisational Transformation.

Jeff Goss

Corporate AdvisorJeff has over 40 years' experience in major projects, banking and project finance, construction, corporate and commercial transactions. He brings to major projects a unique combination of construction, financing and risk assessment skills. Jeff has particular expertise in: infrastructure and construction. risk assessment and liability negotiations joint venture arrangements commercial acquisitions, mergers and divestments structuring of new business enterprises Jeff has advised on major infrastructure projects covering the equity and financing arrangements, the construction and concession documents and all other ancillary documents. He has undertaken major financing transactions including: infrastructure projects; project financing of major mining facilities; sale and lease back transactions; general equipment financing; corporate and structured financing; and mergers and acquisitions. Relevant experience Banking and project finance Jeff has advised: recently a number of property development companies on financing for major property developments WPG Resources on the $346 million sale of its iron ore assets to OneSteel (now Arrium). WPG Resources on the project financing of the Peculiar Knob DSO Iron Ore Project. An international investment bank on a structured finance transaction between South Africa and Australia. Delta Electricity on the project financing of two biomass co-generation plants. The Australian subsidiary of a Scandinavian manufacturing company on two stages of Water Treatment Plants in Sri Lanka. The approximately $600 million acquisition and subsequent sale of Delhi Petroleum Ltd including the innovative financing arrangements for its acquisition structured through Westpac Group. Various lenders to major Australian resource companies on project financing of copper, gold and iron ore projects both in Australia and PNG. - Junior resource companies on the project financing of gold and copper projects. - Obayashi Corporation on financing aspects of the Sydney Olympic Stadium. - Obayashi Corporation on the Sydney Superdome. - Obayashi Corporation on the Hills Motorway Project. Corporate and commercial - Recently advised a privately owned energy company on shareholder and unitholder issues - Advising Eastern Metals Limited on its IPO and on the acquisition of mineral exploration tenements in Northern Territory and NSW - Chrysler Australia Limited on reorganisation of the distributor arrangements for Fiat and Alfa Romeo in Australia and New Zealand. - Charterhouse Group on its acquisition of Hamilton James and Bruce Group Limited, a listed company. - Acquisition of Delhi Petroleum by Australian Petroleum Investment Pty Limited. - Establishment of residual value investment business for Mariner Financial Limited. - Transfield Obayashi Joint Venture for the construction of Melbourne City Link. - Liability negotiations on the Burnley Tunnel. - Project financing of the Sunshine Electricity Biomass Cogeneration plants. - Sale and lease back of Kurnell Oil Refinery. - Corporate financing of the merger between Caltex and AMPOL. Significant leadership positions - Currently Managing Director Andelain Consulting Pty Limited - Former Chairman – Hamilton James & Bruce Group Limited - Former National Managing Partner – KPMG Legal - Former Chairman – Middletons Moore and Bevins (Sydney) - Former Resident Partner Moore & Bevins Hong Kong Branch - Industry innovations in which Jeff has undertaken a leading role include the development of the Australian Interest Rate Swaps Terms (achieving deregulation of interest in a regulated environment), the development of Aussie ISDA (the Australianisation of the ISDA Code for Swaps) and the standardisation of international loan documents.

Services

DEBT SOLUTIONS

We provide debt solutions to a cross section of industries. Whether you're after a simple vanilla facility or a highly structured debt facility we can help. The team is quite competent in the following debt types: - Securitisation - Asset finance - Yellow goods finance - Debt advisory and consulting

PRE-IPO EQUITY

A Pre-IPO equity raise allows companies to raise equity at a smaller discount to their future IPO price as opposed to their current valuation. It also means that whatever the future IPO price, investors will have a parcel of liquid shares that they've obtained at a discount to their opening value.

PRIVATE EQUITY

We have an ever expanding group of investors who trust us to place their funds in the appropriate investments.

CONSULTING

We have vast experience in many aspects of finance from simple debt solutions to complex securitisation structures in a variety of industries and will add value to you and/or your business. You can choose to engage us either on a daily basis or on retainer (for longer engagements).

Learn More

SECURITISATION

Whether you require a simple warehouse facility or a full blown securitisation structure, We can help. Our team members cut their teeth on some of Australia's first securtisation transactions. As finance consultants we have access to most major bank and private warehouse facilities.

Learn More

RISK ASSESSMENT

The service we offer can be a bespoke risk model for assessing counter-party risk for lending, construction, or any other business where counter-party risk assessment is required. Our risk clients range from State Government agencies to engineering firms.

Learn More

SYNDICATED ANGEL INVESTING

Angel investors invest seed capital in startups. The criteria for this is quite strict and founders must pass a rigorous screening process and the investment must stack up. Please contact us for an initial discussion. Preference will be given to ethical investments with a global application.

Learn MoreContact

- Also available in most other locations.

- +61-(0)409 157 873 - Cheyne Ghoughassian

- +61-(0)421 050 376 - Mark Kogos

- cheyne@carche.com.au

- Mon-Fri - 09:00-19:00

Licences

Cheyne Ghoughassian: 001291760

Mark Kogos: 001291761

Disclaimer

This website/page provides general information only and has been prepared without taking into account your objectives, financial situation or needs. We recommend that you consider whether it is appropriate for your circumstances and your full financial situation will need to be reviewed prior to acceptance of any offer or product. It does not constitute legal, tax or financial advice and you should always seek professional advice in relation to your individual circumstances.